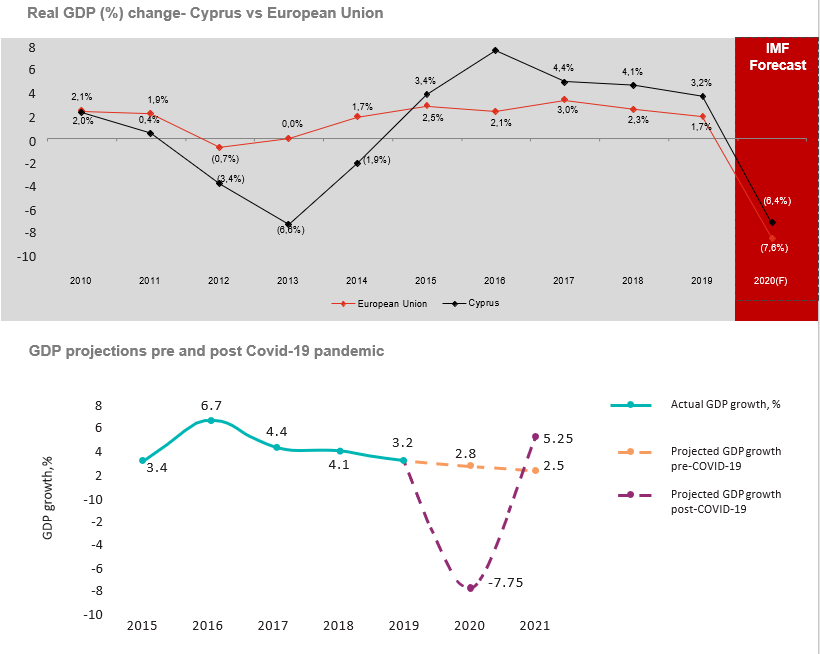

Cyprus GDP has been growing from 2015 up to 2019 (3.2%), with an average real GDP growth of 4.4% per year. The European Central Bank (ECB) projected a -7.75% contract in Europe’s real GDP, compared to -6.4% for the Cypriot Economy in 2020. The economy is forecasted to partially recover in 2021 by 5.25% and fully recover by 2022.

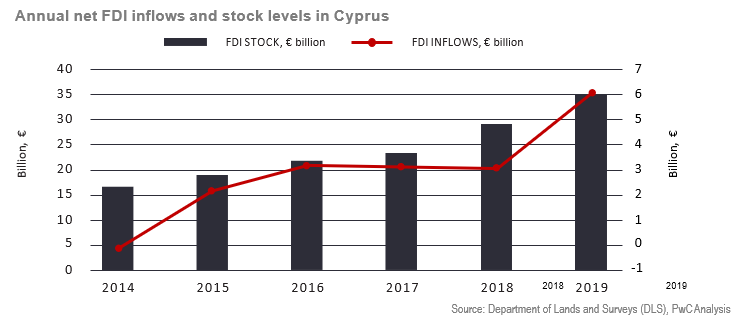

Cyprus was ranked #8 out of the top 20 countries globally for FDI performance and appeal in 2018 and #1 out of 31 islands in the 2019-2020 island Economies of the Future by the Financial Times FDI Intelligence Division. According to Central Bank of Cyprus, Foreign Direct Investments in Cyprus amounted to 6 billion for 2019 and FDI stock at 34.7 billion. This growth in FDI inflows is attributed to the improvement of the country’s macroeconomic outlook and is reflected by the healthy grow rates and the upscaling of the country’s creditworthiness. When established investors were asked to rate the attractiveness of Cyprus in terms of access to financing and corporate taxation, 75% consider it a very attractive factor to invest in Cyprus.

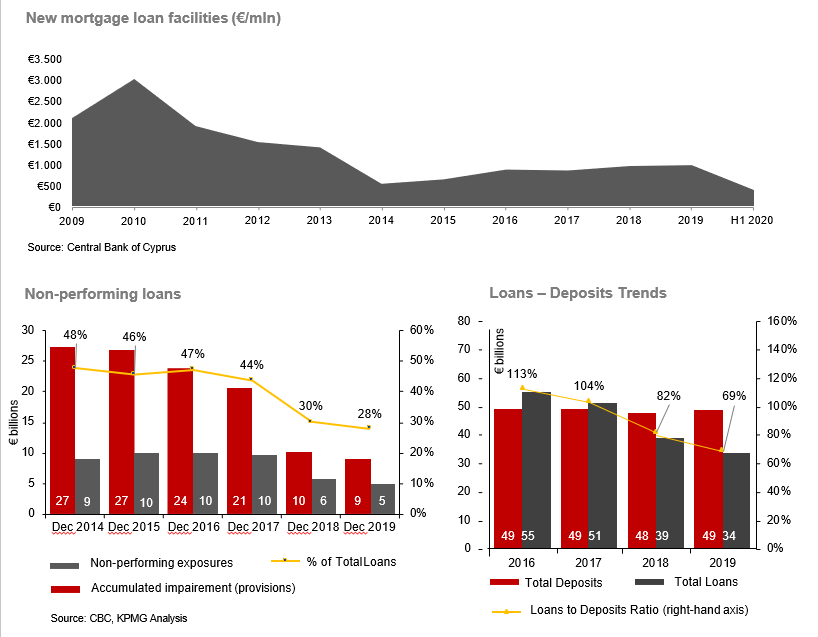

Non-performing household Loans have more than halved since 2011 indicating the banking system's surplus liquidity. The decline in loans is attributed in an effort by the banks to de-leverage their balance sheets. New mortgage loan facilities in the first half of 2020 dropped by 17.9% (86mln) compared to 2019 in the same period. The drop is highly related to restriction measures imposed due to COVID-19 pandemic. Banks are willing to grant new loans to viable buyers, and exercise caution when the applicant has low credit and reduced revenues. Mortgage interest rates have been declining since 2013 and are at an all time low, in some cases dropping to 2.1%. Moreover, the Cyprus government introduced a 4-year subsidy of interest rates, up to a maximum of 1.5% for new housing loans under the 300.000 price range to boost the demand for new mortgages.

The real estate sector is on of the key pillars of the Cyprus economy and constituted 17% of the country’s Gross Value Added (GVA) from June 2019 to June 2020. Respectively, from June 2018 to June 2019 the real estate sector exhibited a rapid growth, up to 11% growth in GVA. Real estate and Construction remained the fastest growing sector amidst the pandemic experiencing a 4% growth in GVA. Regardless of the disruptive nature of the pandemic and the suspension of the Cyprus Investment Programme, the sector remains strong highlighting its importance in the overall economy.

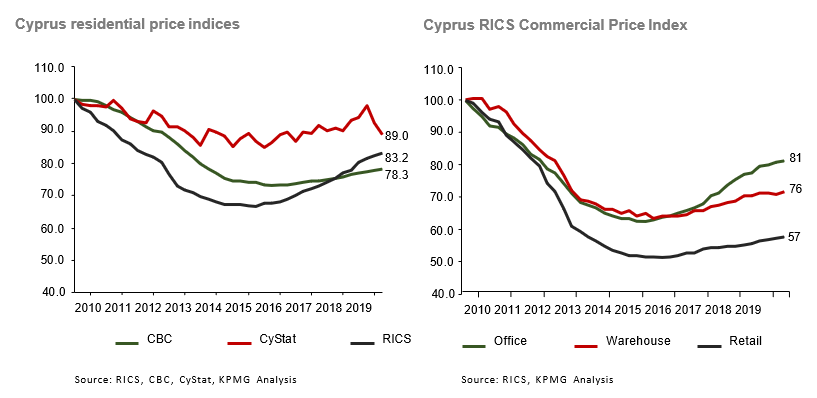

Residential prices evolution is being monitored by RICS, CyStat and the CBC. Negative trajectories have been observed between 2010 and 2016, however the trend was reversed in early 2017. For the last quarter of 2019, Cystat showed a decrease in prices while the CBC and RICS displayed increases.

According to RICS, residential yields have been relatively stable, both for apartments and houses. Latest available data (end of 2019) indicates a yield of 2,6% for houses and 5,0% for apartments. Commercial yields experienced more volatility since the economic crisis of 2013 but have shown considerable growth in 2017 to 2019 with yields reaching 5.7%.

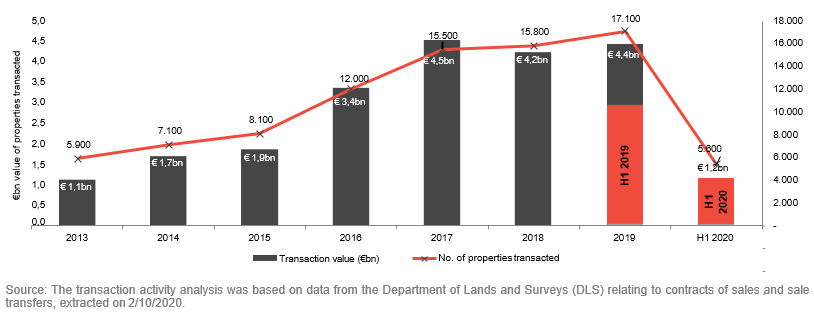

Contracts of sale and sale transfers is used to calculate the total volume and value of properties transactions. The growth of the past 5 years have been reversed in H1 2020. The total number of properties transactions experienced a significant drop, 36%. In terms of value, the drop was even sharper [7], 55%. Pre-lockdown (Jan-Feb) transaction volume was in-line with last year, however a drop of 21% was experienced in transaction value. Post-lockdown (June) transaction volume was in-line with June 2019 but again transaction value experienced a 16% drop.

All the provinces of Cyprus have suffered a significant drop in real estate transactions that took place in the first half of 2020. Specifically, Famagusta showed a decrease of 26% in the total number of transactions but an even greater decrease in value, reaching 56%, compared to the same period of 2019 (- € 407 mln).

Demand based on transaction’s volume and value by type

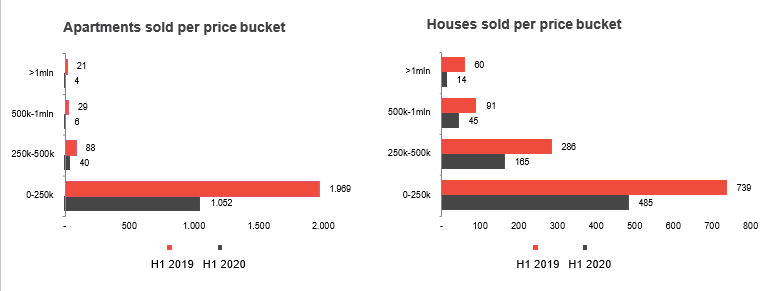

In the first half of 2020 there was more demand for apartments than for houses and compared to 2019, both apartments (-67%) and houses (-56%) had a significantly reduced total value.

In particular, there were a total of 3500 transactions in terms of housing units, of which 2200 represent apartments and 1300 houses. Compared to the corresponding period of 2019, there was a decrease in total transactions by 42%. At the same time, there is a significant drop in their total value after falling by 60%. This suggests that the housing units traded during this period of 2020, had on average a lower price compared to 2019.

The residential real estate sector (apartments and houses) held a total of 69% of the total value of transactions in the first half of 2020, while in 2019 in the same period it held 77%.

In addition, in the first half of 2020 there was more demand for apartments ranging from € 0 - € 250,000 and for homes there was more demand for which prices ranged from € 0 - € 250,000 while at the same time there was a lower demand for homes that their prices were from € 250,000 - € 500,000.

Cyprus Economy is on its way to recovery from Covid's negative impact. Real Estate remains strong and has no signs of slowing down. Bank interest rates are at an all time low and will remain stable for some time.Government incentives along with low bank interest rates is a great opportunity for purchasing real estate. During the lockdown real estate value experienced a sharp drop but has partially recovered post lockdown. Investors seem to prefer apartmetns as the type of investment, a factor contributing may be higher rental yields for low value smart investment.

Share On Facebook

Share On Facebook Share On Twitter

Share On Twitter Share On Linkedin

Share On Linkedin